Dark clouds are gathering over the Canadian economy, but most households don’t know it yet. A new research report from BMO Capital Markets warns that young people are facing a “terrible twin problem” of rising unemployment and skyrocketing home prices. The combination of these two problems is creating an environment comparable to the worst recession in Canadian history. The problem has been largely overlooked, but given how quickly the economy is deteriorating, it may be time to pay attention.

Canada goes from labour “shortage” to skyrocketing unemployment in just a few months

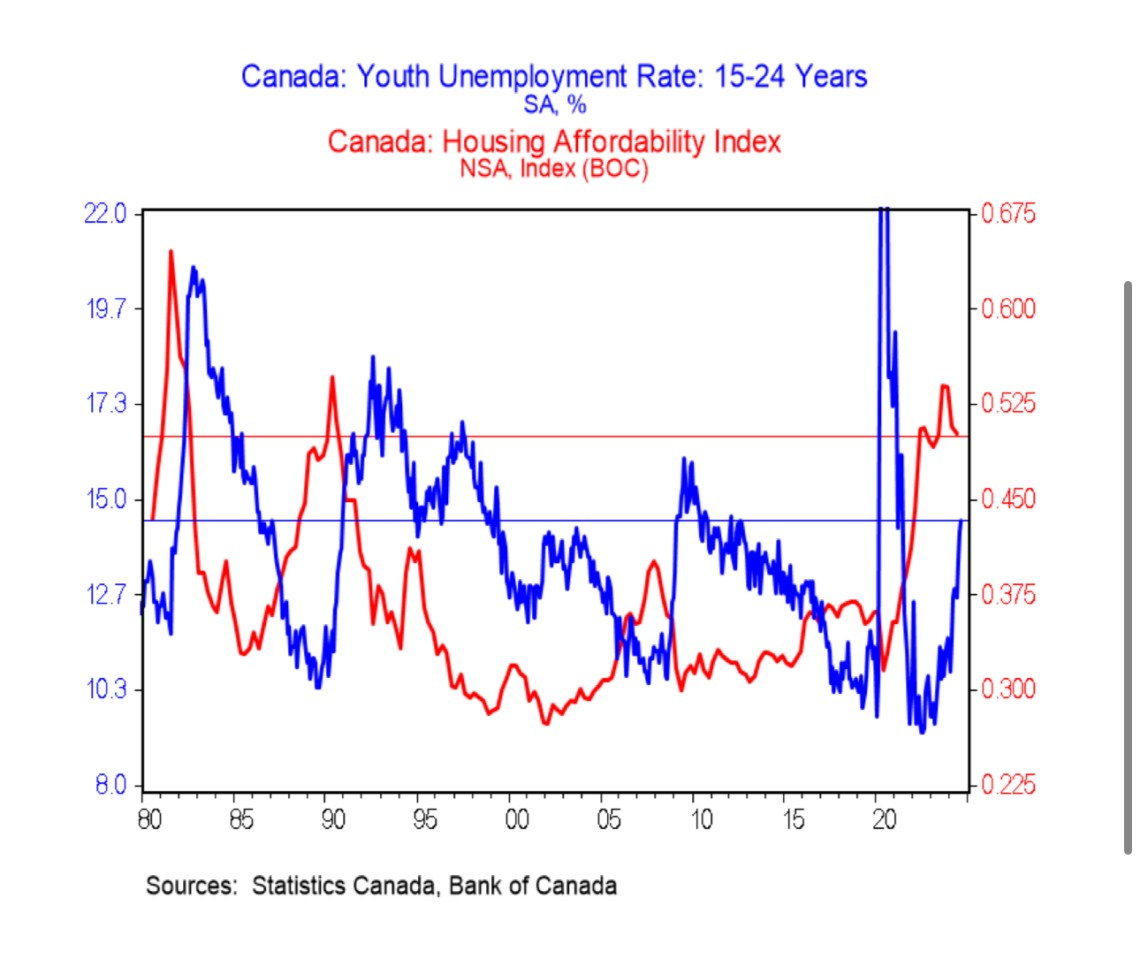

Canada’s unemployment rate is rising at an unusually rapid pace, but it’s mostly among young people. Youth (15-24 years old) unemployment rose to 14.5% in August, the highest rate in over a decade excluding the recent pandemic. This has gone unnoticed by most families because the labour surplus has not yet impacted the core generation of workers, but there’s no doubt that the issue will soon affect them as well.

“[The youth unemployment rate is]”…the unemployment rate for 25-54 year olds is 2.7 times higher, the highest it’s ever been,” warns Douglas Porter, chief economist at BMO.

Porter further highlighted this gap and how quickly it had formed, adding: “The proportion of young people has certainly been higher in the past – if you look at the early 1980s, much of the 1990s and even 2009/10 – but this is a sharp change from the tough markets of much of the past decade.”

In the space of just a few months, young Canadians have gone from hearing about labour shortages to facing unemployment rates not seen outside the worst of the recession.

Young Canadians still face worst housing market on record

Young people facing a worsening job market is an alarming trend in itself, but when combined with the existing housing crisis, it becomes even more problematic. Housing was out of reach in major cities even before the pandemic, but now rising home prices have become a nationwide trend. It’s difficult to pay for housing when rents are rising far more than people earn. It’s nearly impossible to pay for housing without a job that pays the bills in the first place.

Home affordability in Canada has only improved slightly due to falling prices and interest rates. [housing affordability] “Bank of Canada data shows it improved slightly again in the second quarter but is still very weak,” Porter said.

The bank says home affordability did worsen slightly from the early 1980s to the early 1990s, but the combination of factors has created an environment not seen outside the deepest recessions.

“For young people, it’s going to be a) hard to find a job now and then, maybe later, and b) hard to find affordable housing. And when you combine the two, it’s going to be just as hard as it was in the early ’80s and early ’90s,” Porter warns.

In the 80s and 90s, housing prices crashed and the problem of home affordability was resolved relatively quickly: there were a few years of decline, followed by long periods of affordability. For example, it took Toronto real estate 22 years to return to its inflation-adjusted home price peak of the early 90s.

Experts don’t expect a correction or slowdown of this magnitude yet. The Bank of Canada, in particular, has been using unconventional monetary policies such as quantitative easing, flooding investors with cheap credit, to spur demand and support prices at a time when households face a weak economy. This doesn’t always work, but many expect it to in the short term.

You may think this is unfortunate, but it’s not your problem, but you’re wrong. Experts warn that financial insecurity among young people could have implications on everything from population decline to the country’s financial stability, the latter of which even the nation’s largest banks have warned about.

You may also like

#Young #Canadians #Face #Rising #Unemployment #High #Home #Prices #BMO #Dwelling